Best Investment Books Fundamentals Explained

Wiki Article

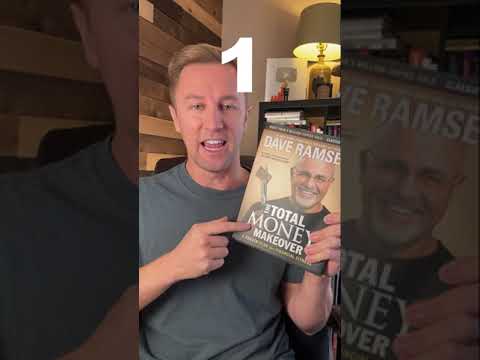

Best Investment Textbooks

Now could be an excellent time for any person--from expert investors to new savers on the lookout for direction--to increase their investing know-how. There are lots of guides in existence to aid On this exertion.

Investing is about being familiar with how revenue will work and forming a favourable revenue state of mind - these publications on expense will supply all the things you need to know!

The Minor Book That also Beats the industry

An training on investing and cash matters immensely on your economic wellbeing as time passes. No matter whether you are just getting going in investing or have now begun conserving some of your spare adjust absent, there are a lot of guides available to information your journey into shares and funds matters - regardless of whether Which means buying Peter Lynch's brain or Studying from Warren Buffett himself! With so much advice available on investments from both of those Peter and Warren to information us toward economical accomplishment, these major investment decision guides can manual us down an useful fiscal route.

Best Investment Books for Dummies

Realistic examples and a straightforward-to-examine structure make this e book critical reading for any person enthusiastic about investing their dollars. Prepared by a seasoned investor based on John Bogle's rules and methods, it provides a simple guide for building your portfolio using his tried-and-examined techniques. Furthermore, this e book also addresses fundamental investing matters like opening a brokerage account and getting shares among lots of Other folks.

Realistic examples and a straightforward-to-examine structure make this e book critical reading for any person enthusiastic about investing their dollars. Prepared by a seasoned investor based on John Bogle's rules and methods, it provides a simple guide for building your portfolio using his tried-and-examined techniques. Furthermore, this e book also addresses fundamental investing matters like opening a brokerage account and getting shares among lots of Other folks.This reserve gives an in-depth introduction to price investing, outlining its vital concepts and methodologies. Penned by famous Trader Joel Greenblatt, this modern-day basic offers his experimented with-and-tested methods of finding profitable stocks. A essential facet of Joel Greenblatt's method will involve being familiar with a company's economic moat - an advantage which no other competitor can match - and this guide delves deep into exploring quite a few productive firms' exceptional aggressive rewards together with detailing how these benefits need to be recognized in its stock rate.

While revealed many years ago, this ebook still offers timeless tips for buyers and business owners alike. Graham attracts upon his ordeals to emphasize the significance of averting psychological or psychological triggers which cause very poor conclusion-making processes. Every severe investor ought to study it at least when.

With its Dr. Seuss-esque format, this e-book simplifies investing for younger audience while Grown ups can even locate it informative and entertaining. The intention is to have teenagers investing early even though teaching them the value of saving, investing and paying out sensibly; additionally it emphasizes compound interest for a type of monetary liberty, sharing stories from teenager business people who inspire long run generations to hunt economic independence.

The Psychology of Investing

When investing dollars, a strong education and learning in how to take care of it is needed. While some of present day top rated traders gained official training, Other people can have taught by themselves via self-Finding out or studying the classics composed by specialist traders who may possibly preserve you from earning popular faults that new investors make.

Not known Details About Best Investment Books

Burton Malkiel's book delivers an introduction to investing with out being overpowering for starter investors or These seeking an expanded understanding base. Malkiel favors index cash in excess of stock buying, and gives strategies for estimating potential returns.

Burton Malkiel's book delivers an introduction to investing with out being overpowering for starter investors or These seeking an expanded understanding base. Malkiel favors index cash in excess of stock buying, and gives strategies for estimating potential returns.This basic from 1923 stays well known with investors right now and is also greatly regarded as their go-to guide on investing. It outlines all of the actions required to develop into economically impartial, which includes placing aside 10% of one's earnings and investing it wisely; also furnishing advice about looking for steering and keeping away from irrational behavior.

Graham is commonly acknowledged as the father of worth investing, which involves acquiring stocks at lessen than their intrinsic truly worth. Along with detailing this strategy and How to define them, Graham also discusses hazard tolerance along with his character, Mr. Marketplace - an allegory for a way inventory markets fluctuate amongst providing affordable goods at just one second and more expensive kinds at A different - representing its schizophrenic nature. During time, The Clever Trader continues to be revised multiple situations; new editions by Jason Zweig consist of modern-day commentary.

This ebook is crucial reading for just about any investor who's curious to get an understanding of the psychology of investing. It explores how selections created by newcomers to investing may have a dramatic impact on extended-expression source returns and gives approaches to overcome popular behavioral biases. Moreover, its authors share procedures on staying away from overdiversification, taking on too much credit card debt, and following developments - a few popular pitfalls encountered when beginning investing.

Examine This Report about Best Investment Books

Seth Klarman's guide on financial investment is considered one thing of a holy grail by viewers. Getting An economical duplicate is nearly extremely hard and sellers ordinarily cost upwards of $one,000 for just one quantity. His conservative worth-based solution reveals his understanding of financial check here moats - competitive strengths best investment books that no other organizations can replicate - along with the value of calculating selling price when investing.

Seth Klarman's guide on financial investment is considered one thing of a holy grail by viewers. Getting An economical duplicate is nearly extremely hard and sellers ordinarily cost upwards of $one,000 for just one quantity. His conservative worth-based solution reveals his understanding of financial check here moats - competitive strengths best investment books that no other organizations can replicate - along with the value of calculating selling price when investing.The Warren Buffett Way

Warren Buffett's books ought to be demanded examining for anyone associated with investing. While renowned for his philosophies on investing, On this reserve he also aspects why he approaches investing in a different way from Some others. Audience will acquire an in-depth look at into this side of finance.

Written in 1958, this timeless e-book supplies important wisdom that still applies these days. Its major aim is determining attributes that define a beautiful organization; with suggestions like using "the scuttlebutt system" to realize Perception into this sector by pursuing what opponents say about certain firms.

Benjamin Graham was an icon on the earth of investing, and his book The Clever Investor is greatly regarded as the definitive investment guide. Graham taught viewers price investing - the exercise of analyzing companies' intrinsic values and paying for shares at charges a lot less than their truthful current market costs - which the Penny Hoarder considers crucial reading through product for the people keen on rising their cash via investing.

Peter Lynch is definitely an esteemed Wall Avenue manager known for his very long-phrase achievements at beating the marketplace. In One Up on Wall Avenue he delivers clear-cut assistance about his successes (and failures) at Fidelity's Magellan fund.

For any person who believes that achievements in investing comes effortlessly, this e book offers a captivating examine. Filled with stories about Individuals who have designed wealth by getting threats and next their instincts, this ideal-seller gives insights into developing prosperity through investing.